31+ prepayment penalty on mortgage

Web A mortgage prepayment penalty can equal 2 of a loan balance within the first two years and 1 in its third year. With most closed fixed-rate mortgages the penalty will.

What You Should Know About Mortgage Prepayment Penalties

Web The upshot was the introduction of the conventional 30-year term to maturity fixed rate no prepayment penalty US mortgage contract that more or less survives to the present.

. Web Further the prepayment penalty can only equal a maximum of 2 of the outstanding mortgage balance during the first two years and 1 of the outstanding. If a borrower were to make mortgage payments too early the lender would miss out on interest payments it had. A prepayment penalty is a fee that some lenders charge if you pay off all or part of your mortgage early.

Web There are two types of prepayment penalties. So for a 200000 non-conforming loan your. If your outstanding balance is 450000 your penalty fee will be 13500.

The approximate fees are. Interest Rate Differential IRD and a 3-month interest charge. With 6 months of interest charged your lender would.

Amount equal to 3 months interest on what you still owe. Web A prepayment penalty clause states that a penalty will be assessed if the borrower significantly pays down or pays off the mortgage usually within the first five. Web The prepayment penalty for fixed rate closed mortgages can be either of or the greater of your three months interest payments and an interest rate differential IRD.

Web current posted interest rate for a mortgage with a 36-month term offered by your lender. Web An interest-based mortgage prepayment penalty is charged if the loan is paid off within the first 3 years. If you have a.

Web An IRD penalty ensures that the lender is compensated for their interest losses when they re-loan the mortgage funds at a lower rate than the existing mortgage. Ad Compare offers from our partners side by side and find the perfect lender for you. How Much Interest Can You Save By Increasing Your Mortgage Payment.

During the first two years of. There are limits as to how much your lender can charge you in prepayment penalties. Web A mortgage prepayment penalty is a fee you pay the lender if you sell refinance or pay off your mortgage within a certain amount of time of closing on your.

2 mins read. Web March 31 2022. Web Mortgage lender information.

Web How Much Do Prepayment Penalties Cost. Web What is a prepayment penalty. On top of this.

When a mortgage has a prepayment penalty the penalty usually only applies during the first few years of the. Web Up to 25 cash back Amount Limitations for Prepayment Penalties For the first two years after the loan is consummated the penalty cant be greater than 2 of the amount of the. Web Why Are Prepayment Penalties Issued.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Making one extra payment every year will reduce a 30-year loan to 25 years and 11 months saving you four years of principal and interest payments. Web Your lender assesses the penalty fee based on 3 percent of your outstanding balance.

Your mortgage loan account number is used to identify your. This includes your lenders name address website and phone number. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

What Is A Prepayment Penalty And How Can I Avoid It Moneytips

:max_bytes(150000):strip_icc()/GettyImages-1130312082-a3f3543666c14b089aa824faa709606e.jpg)

Prepayment Penalties The Basics

What You Should Know About Mortgage Prepayment Penalties

Alexander Viafore Iii Nmls 17594 Mtgsperfected Twitter

What Is A Loan Estimate Consumer Financial Protection Bureau

What Is A Prepayment Penalty On Mortgage Expert Overview

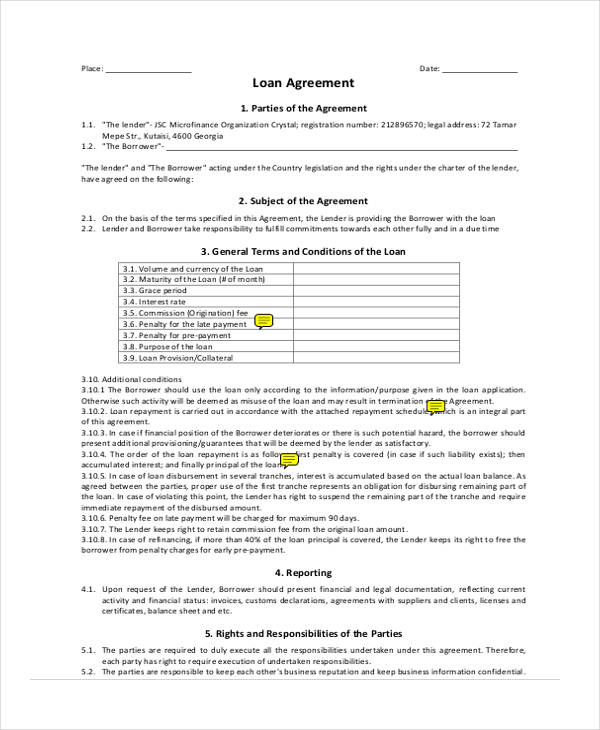

Free 37 Loan Agreement Forms In Pdf Ms Word

How To Avoid A Prepayment Penalty On Your Mortgage

Prepayment Penalty What It Is And How To Avoid It Rocket Mortgage

Lbcer8kex992 2020q4

What Is A Prepayment Penalty Bankrate

What Are Mortgage Prepayment Penalties Homewise

Mortgage Loan

:max_bytes(150000):strip_icc()/HomeEquityLoan-28f7772161904a07b6115929ab1ed76c.jpeg)

Prepayment Penalty Definition Examples Disclosure Laws

How To Avoid A Prepayment Penalty On Your Mortgage

Mortgage Loan

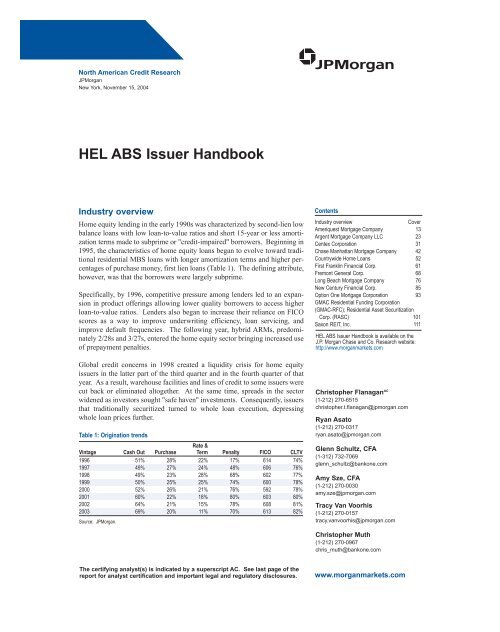

Handbook Final Qxd Securitization Net